dallas texas sales tax rate 2020

Candy soft drinks alcoholic beverages and food prepared for immediate consumption do not qualify for the 1 rate. The important question surrounds who is responsible for paying for this.

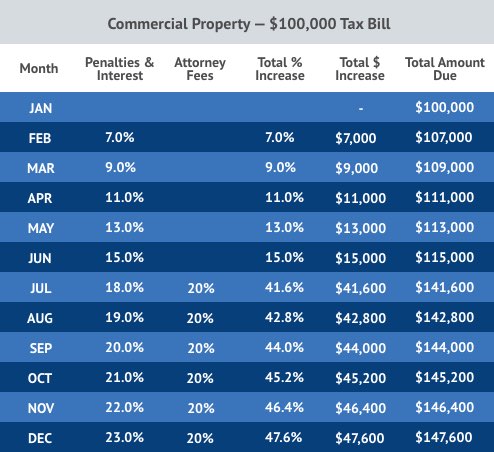

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease

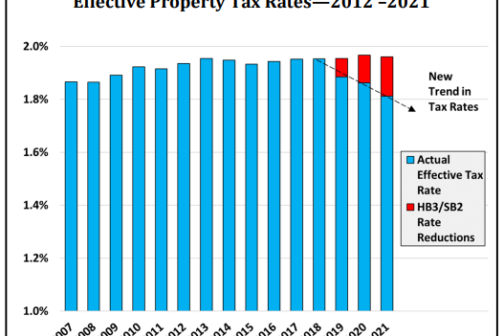

With the Reformed Property Tax Code of Texas the annual increase will be limited.

. Property tax is ad valorem. Property taxes are the only tax that can be appealed. And the power produced by these installations is increasing rapidly.

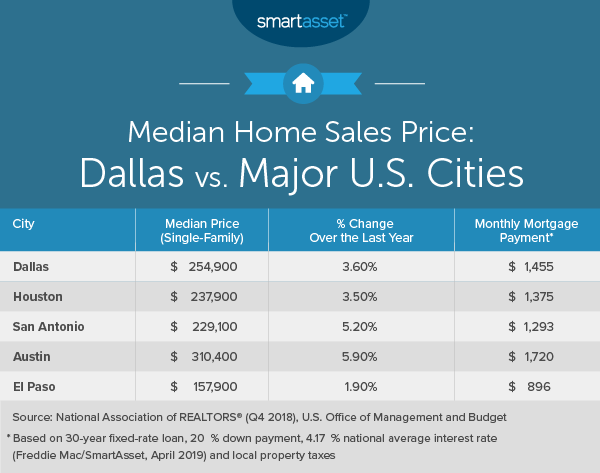

The median property tax in Harris County Texas is 3040 per year for a home worth the median value of 131700. The Dallas housing market is doing great after recovering from the blows of the pandemic since July of the pandemic year. Texans can now eat in shopping mall food courts go bowling drink in bars eat in restaurants watch rodeos get their hair fixed and get steaming mad about their property taxes.

In fact he wished for a 25 cap but it was amended to 35 which was approved by the House. Illinois sales tax on grocery items Although grocery items are tax exempt in most states this does not apply to you if you live in Illinois. Texas car tax is going to vary because of city county and state taxes.

Texas had some of the highest average closing costs for single-family home refinances in the nation in 2021. Demand for single-family homes has risen and supply has lagged since the second half of 2020. But there are some taxing units such as community colleges that levy property taxes.

You can enter the city and county you live in and then will be given the rate of taxation for that location. They set the local tax rate. Between December 2016 and December 2017 net solar power generated by Texas utilities and small-scale solar PV facilities PDF rose by more than 107.

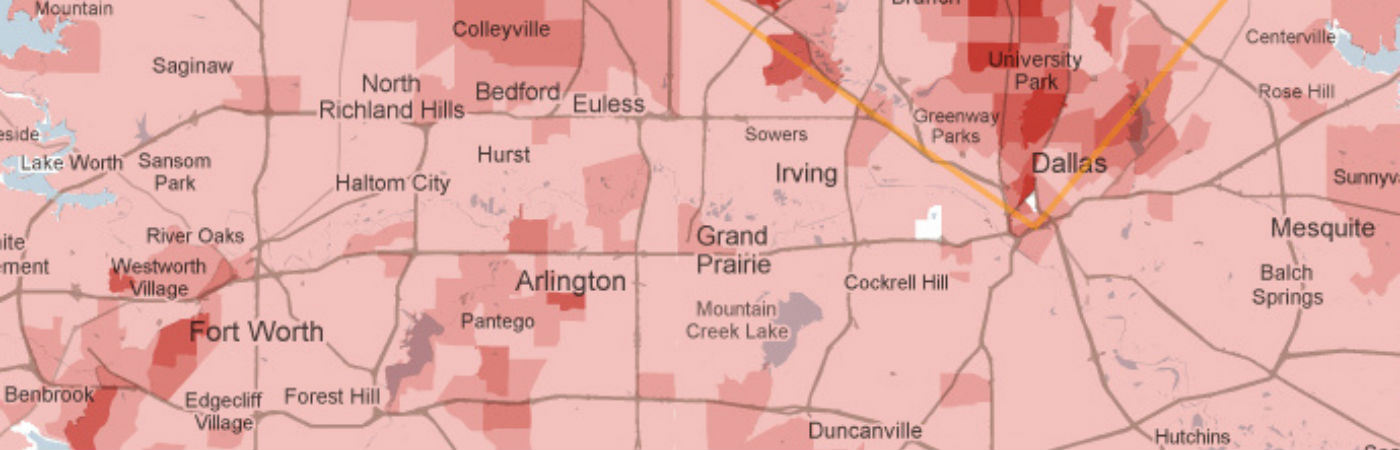

Texas is notorious for its property taxes and more than 200000 DFW homeowners are taking action so far. Dallas Area Rapid Transit DART is a transit agency serving the DallasFort Worth metroplex of TexasIt operates buses light rail commuter rail and high-occupancy vehicle lanes in Dallas and twelve of its suburbs. The Cotton Bowl is an outdoor stadium in Dallas Texas United StatesOpened in 1930 as Fair Park Stadium it is on the site of the State Fair of Texas known as Fair Park.

Property taxes are one of the most significant taxes for many Texas families. Harris County has one of the highest median property taxes in the United States and is ranked 152nd of the 3143 counties in order of median property taxes. For the seventh consecutive year the number of Texas house sales and the median price reached all-time highs according to the Texas REALTORS.

DART was created in 1983 to replace a municipal bus system and funded expansion of the regions transit network through a sales tax levied in member cities. Harris County collects on average 231 of a propertys assessed fair market value as property tax. The best way to figure these taxes is to go to the website for taxes in Texas.

Ad valorem means based on value. Texas has a high sales tax and no personal income tax. Grocery items are not tax exempt but they are taxable at a reduced rate of 1.

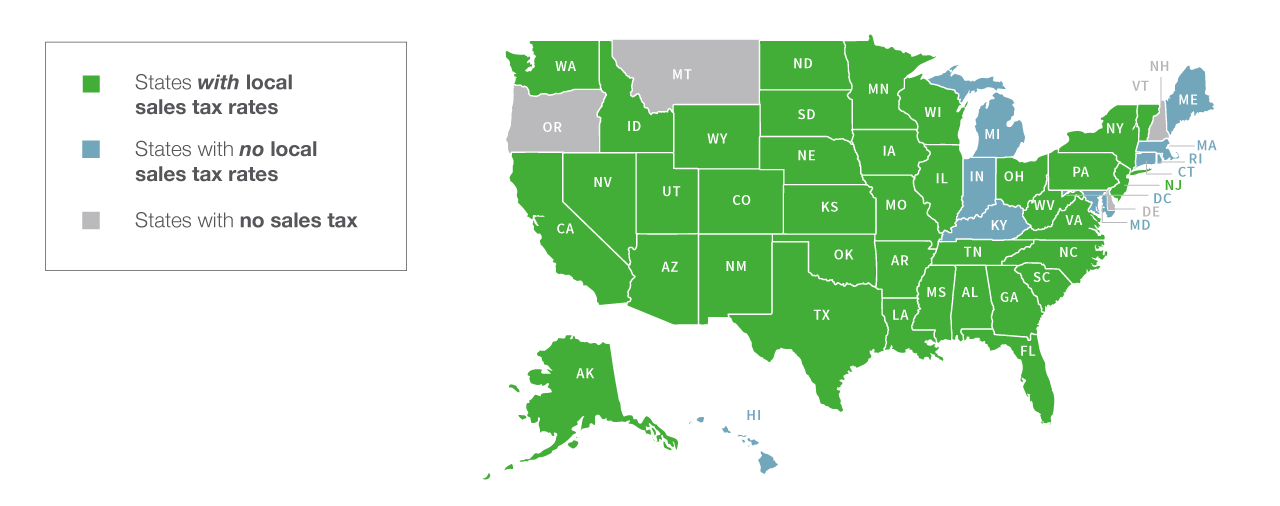

When you compare it to Texas 625 sales tax rate tax rates of 0575-1 seem pretty low. The number of parcels to value in Texas is huge. Each city has their own rates of taxation as do the counties as well.

At the metro level the. But in context the total costs are pretty significant. Reasonable people can disagree on value.

A recent report by Environment Texas and Frontier Group indicates San Antonio leads the state in solar PV capacity and ranks eighth among US. The Cotton Bowl was the longtime home of the annual college football post-season bowl game known as the Cotton Bowl Classic for which the stadium is namedStarting on New Years Day 1937 it hosted the. Said the most protests their office received was in 2020 when 178358 people filed.

Texas Governor Greg Abbott was in favor of this limit. An officer conducting a sale of real property under this subchapter may not execute or deliver a deed to the purchaser of the property unless the purchaser exhibits to the officer an unexpired written statement issued to the person in the manner prescribed by Section 34015 Tax Code showing that the county assessor-collector of the county in which the sale is conducted. 1 of 10 million is still 100k.

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

Texas Sales Tax Small Business Guide Truic

Tax Rates Richardson Economic Development Partnership

What You Should Know About Dfw Suburb Property Taxes 2021 Nail Key

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

Cost Of Living In Dallas Smartasset

10210 Strait Ln Dallas Tx 75229 Photo View Photos Stairwell Home Values

2021 2022 Tax Information Euless Tx

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Texas Sales Tax Guide And Calculator 2022 Taxjar

Federal Estate Tax Rate Schedule Dallas Business Income Tax Services

Taxes Don T Have To Be Scary I Can Sell Your House And Save You Money At The Same Time Send Me A Message To G Tax Deductions Selling House Selling Your

Texas Sales Tax Rates By City County 2022

What You Should Know About Dfw Suburb Property Taxes 2021 Nail Key

Texas Sales Tax Guide For Businesses

Your Property Tax Bill Could Be Way Way Worse D Magazine

Comparing Lowest Property Taxes Of Dallas Fort Worth Homes Can Be Confusing Misleading